Maintaining a Healthy

Cash Flow In Your Business

82% of business failures are a result of poor cash flow management. Need we say anymore as to how important the management of cash is? For some businesses, managing cash flow is the key to surviving while for others, it’s an exercise in financial health.

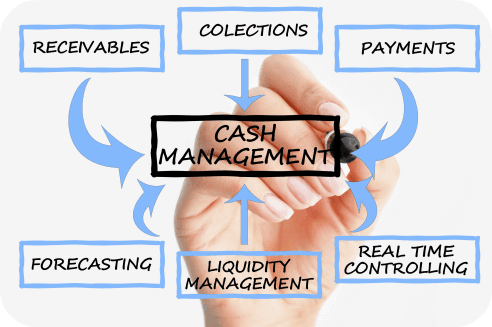

To effectively manage cash, you must monitor, analyze, and optimize cash flow in and out. It requires the balancing of income against expense items. Your goal is to ensure you have enough cash on hand to operate your business the way you want to operate it without having to worry about having enough cash to do it with. It doesn’t mean you should be increasing your expenses with the hope you can triple your revenues. It means you should focus on increasing profits without assuming you need to cut back somewhere. That is why it is essential to have a solid financial projection of your business that is continuously updated. Here is how we can help you.

Get a copy of "Cash Flow Do's and Don'ts Cheat Sheet"

Cash Management: How We Help You

Cash Flow Projections

We help you to understand when, where, and how cash needs will take place. We can help you develop a short-term (weekly, monthly), and long-term (annual, 3-5 year) cash flow projections for the capital strategy to meet the needs of your business.

Debt Collection

We have partnered up with an automated collection service provided that connects to your cloud accounting software. You ONLY PAY a collection agency fee (software is free) when you collect your money. You select which past due accounts to send, and the most reputable agency with the best pricing take care of the rest.

Accounts Receivables (A/R)

Managing A/R is essential to a healthy cash flow. We can help you customize receivable analytics to get your receivables to a healthy level and keep them there. We can also help you monitor and improve your quote to cash and/or cash to cash cycle time

Invoice Funding

"Invoice Funding" or "invoice financing" differs from "Invoice Factoring" in that "Invoice Factoring" companies contact your customers directly to collect payment, thus can interfere with your customer relationships. With "Invoice Funding", companies like Fundbox do not take over collecting from your customers like a typical invoice factoring company. They lend you money based on the amount of invoices outstanding and it becomes part of your line of credit.

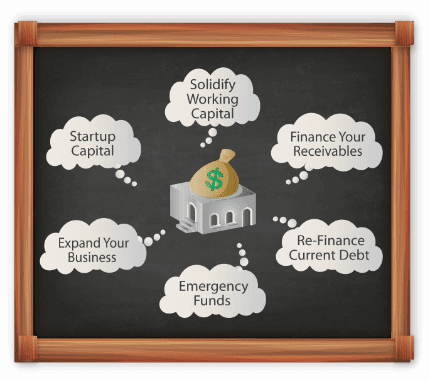

Funding Your Business

Your business may need more funds to grow, funds to fill in cash gaps or to fund your start-up business. Whatever it may be, we can guide you, help you prepare for, and connect you with these products.

SBA Loans

An SBA loan provides small-businesses access to capital guaranteed by the SBA. This capital is issued by participating lenders, which are mostly banks, with more flexible underwriting than conventional business loans as well as lower interest rates, making SBA loans the best loan option for small businesses.

The Good:

- Lower down payment requirements

- Low rates and longer repayment terms so you conserve cash for operating expenses

- Lower capital injection requirements

The Bad:

- Designed for established businesses and borrowers with good credit.

- SBA requires a personal guarantee from every owner with at least a 20% ownership stake

- Patience: SBA loans require an abundance of documentation and take much longer to fund due to a rigid underwriting

Banks

Credit Cards

If you are a new business, build up your credit score by paying off credit card balances each month before it is due. It's important to have a charge each and every month and pay it as quickly as possible. Buy a pack of paper clips if you have to find something to charge.

Which Bank is Best for Small Businesses?

The best all around bank is Wells Fargo. Their unsecured loans and line of credit are their best options. As mentioned earlier, a revolving line is a great option to use for any issues with your cash flow, especially with meeting your payroll. The Wells Fargo line of credit offers reward points similar to credit cards. As for SBA loans, Wells Fargo is the best lender.

Alternative Funding

Advice: "Invoice Funding" differs from "Invoice Factoring" in that "Invoice Factoring" companies contact your customers directly to collect payment, thus can interfere with your customer relationships. With "Invoice Funding" companies like Fundbox, they rely on other factors we explain below.

SmartBiz Loan Products:

SBA: Commercial Real Estate Loans | Debt Refinance Loans | Working Capital Loans

Non-SBA: Working capital, debt refinance and new equipment purchase Loans (Term Loans)

SmartBiz is an online marketplace that connects small businesses to lenders with software that significantly expedites the SBA loan process by automating almost every step of the SBA funding process.expedites the SBA loan process by expedites the SBA loan process by expedites the SBA loan process by

Business Lenaders

Capital is key to release the power of your business and we are introducing SmartBiz and Fundbox below. There are many other options available out there. Alternative funding is a more streamlined way of getting funds as well as being a faster option. However, Alternative funding will cost more in higher interest rates.

Advice: "Invoice Funding" differs from "Invoice Factoring" in that "Invoice Factoring" companies contact your customers directly to collect payment, thus can interfere with your customer relationships. With "Invoice Funding" companies like Fundbox, they rely on other factors we explain below.

Preparing for Your Loan

You can edit text on your website by double clicking on a text box on your website. Alternatively, when you select a text box a settings menu will appear. your website by double clicking on a text The key to getting your loan approved is knowing what the lender is looking for and the application process is no different than selling a product. “Why should I buy your product” or “why should I lend you money” – the more you put in to your answers, the better your chances get.

- They want to know you have a good grasp of running your business and the drive to make it grow

- An organized plan; the lender will know if you are pulling a loan amount out of a hat. Borrow a reasonable amount and ensure your business plan and/or financial documents prove you should get your loan

- Have your loan application reviewed by a CPA or an attorney and have any business plans and/or financial documents signed off by a CPA. This is called commitment, organization, and an investment for something you deserve

Here are some common reasons that small businesses give when they apply for additional funding:

- Expanding your business

- Purchasing inventory

- Replacing equipment

- Buying equipment that will boost production

- Hiring or training new employees

- Implementing a new system

Being prepared:

- Explain how the loan will benefit your business with the right amount of detail

- Know your numbers: show you understand where every dollar will go and how your business will react to the use of the funds

- Ensure your cash flow projections take into consideration the added loan payments. They want to know you can make the loan payments

- KPI’s: The Debt Service Coverage Ratio (DSCR) is a popular measure that lenders use to determine how much debt you can take on. The DSCR measures your business’s income to debt so the higher the better. You will want to be on the north side of 1.25

- Make sure the loan you are applying for is suitable for your business needs. If your need for funding is based on the seasonality of your business, a line of credit or invoice financing is more beneficial than a term loan. In addition, apply according to the requirements for the loan. if your credit score is 625, apply for loans with a required score of 625 or lower. Fyi, personal credit scores are also considered in most small business loans.

- Before any lender asks you questions about certain items on your credit report, know exactly what is on your credit report so you can quickly explain it to your lender prior to the application process. It’s better for lenders to understand your situation before they read about it.

- If the lender requires an X amount of collateral, offer up 2x if you can to increase your chances of being approved. This will show the lender you are serious by risking more of what you own

- A business plan is always good as it shows the lender you are prepared, know what you are doing and that you are responsible since you will be including at least 1 loan repayment strategy.