Form an LLC, Corporation, Get Your EIN, or ITIN, and more

Our services make it easy to form your business and our pricing is hard to beat. Once you decide what you need, you can have a 30 minute consultation with us or proceed and get started below. This is how our easy process works:

- Complete our simple questionnaire on our site and press submit

- We will set up a meeting (in-person or phone)

- We will perform a name search for your company name to ensure it is available

- We will prepare an application and file them with the appropriate government agencies

Pricing and Get Started

Fast, Reliable Document Preparation and Filing

Single Member LLC.

The main purpose for forming an LLC for a new or existing business is to separate your personal assets from your business. This goes for rental properties as well. Please schedule a call with us to help you decide if this option works for you.

Pricing:

Single Member LLC. $175 *

Multi-Member LLC.

The main difference between a Single Member LLC. and a Multi-Member LLC. is the number of owners. A Multi-Member LLC. has more than one owner. Please schedule a call with us to help you decide if this option works best for you.

Pricing:

Multi-Member LLC. $225 *

C-Corporation

The C Corporation tax structure can result in higher taxes with a potential double taxation. Conversely, raising capital becomes somewhat easier for swifter growth. Please schedule a call with us to learn more.

Pricing:

C Corporation $240 *

S-Corporation Election

An S Corporation election for tax purposes has the potential to save you thousands and possibly tens of thousands of dollars a year on taxes each year. We can do the homework for you to see if this option is right for you. Call today.

Pricing:

S-Corp Election. $85

DBA

When a business wants to operate under a name that is different from their legal name, the business will file for a DBA (or “doing business as)”.

Note: We'll prepare and file all required documents to start your DBA. DBA filings differ from state to state and may be needed in the county and possibly in the city where you will be using the name. We know the requirements and will make you compliant.

Pricing:

DBA $89 *

EIN

EIN is short for employer identification number. It is a nine-digit number issued by the IRS and used to identify businesses and individuals for tax purposes.

Business owners need an EIN to open a business bank account, apply for business licenses and file your tax returns. Apply for one as soon as you start planning your business so there are no delays in getting licenses or any financing you may need. Read More...

Pricing:

EIN $70 (included when applying for a business entity)

ITIN

An Individual Taxpayer Identification Number (ITIN) is a tax ID number for individuals who are required to have a U.S. Taxpayer Identification Number but are not eligible to get a Social Security Number (SSN). We can assist foreign individuals in getting their ITIN number by authenticating their identify and filing the required documents.

Single-Member

LLC. Formation

Note:

- By default, your SINGLE-MEMBER LLC is treated as a disregarded entity, therefore, must file a yearly Schedule C with your Form 1040.

- If your SINGLE-MEMBER LLC will be treated as an S-Corp for tax purposes, it must file a yearly Form 1120S.

- If your SINGLE-MEMBER LLC will be treated as an C-Corp for tax purposes, it must file a yearly Form 1120C.

Multi-Member LLC. orPartnership Formation

Note:

- By default, your MULTI-MEMBER LLC is treated as a partnership, therefore, must file a yearly Form 1065 and one of its members must sign the return.

- If your MULTI-MEMBER LLC will be treated as an S-Corp for tax purposes, it must file a yearly Form 1120S.

- If your MULTI-MEMBER LLC will be treated as an C-Corp for tax purposes, it must file a yearly Form 1120C.

S-Corp Election

Note:

- By default, your MULTI-MEMBER LLC is treated as a partnership, therefore, must file a yearly Form 1065 and one of its members must sign the return.

- If your MULTI-MEMBER LLC will be treated as an S-Corp for tax purposes, it must file a yearly Form 1120S.

- If your MULTI-MEMBER LLC will be treated as an C-Corp for tax purposes, it must file a yearly Form 1120C.

Information Needed

for an EIN

- You hire employees

- Your LLC elects a corporate-style taxation structure

- You have a Keogh or solo 401(k) retirement plan

- An existing business is bought or inherited and you plan to operate it as a sole proprietorship, or

- You file for bankruptcy.

- If the ownership or structure of your business changes

- Business changes from a sole proprietorship to a corporation or partnership

- Company changes from a partnership to a corporation or sole proprietorship and vice versa

- Individual owner dies, and business is taken over by the estate.

Information Needs For an Individual Taxpayer Identification Number (ITIN)

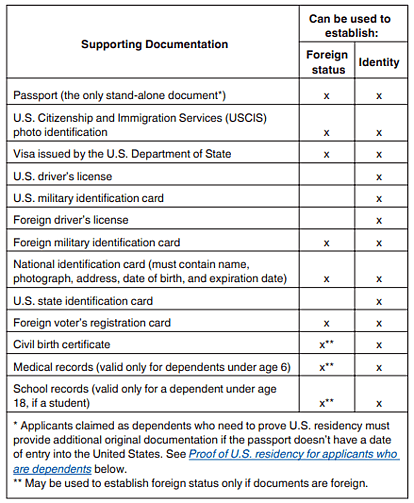

Supporting Documentation Requirements

The documentation you provide must meet the following requirements.

- You must submit documentation to establish your identity and your connection to a foreign country (“foreign status”). Applicants claimed as dependents must also prove U.S. residency unless the applicant is from Canada or Mexico or the applicant is a dependent of U.S. military personnel stationed overseas.

- You must submit original documents, or certified copies of these documents from the issuing agency, that support the information provided on Form W-7. A certified document is one that the original issuing agency provides and certifies as an exact copy of the original document and contains an official stamped seal from the agency. You may be able to request a certified copy of documents at an embassy or consulate. However, services may vary between countries, so it’s recommended that you contact the appropriate consulate or embassy for specific information.

- The documentation you provide must be current (not expired).

Internal Revenue Service

ITIN Operation

P.O. Box 149342

Austin, TX 78714-9342

Every business and every individual person in the U.S. needs a tax identification number for TAX PURPOSES. The U.S. government and the IRS wants to be certain anyone who earns money pays taxes.

An Individual Taxpayer Identification Number (ITIN) is a tax ID number for individuals who are required to have a U.S. Taxpayer Identification Number but are not eligible to get a Social Security Number (SSN). We can assist foreign individuals in getting their ITIN number by authenticating their identify and filing the required documents.

As for a Social Security Number (SSN), they are available to all United States citizens, permanent resident aliens and temporary residents authorized to work through a work permit.

An ITIN is issued by the IRS and is needed to file taxes and open a U.S. bank account when a Social Security Number (SSN) is not available. An ITIN is easy to identify, as it always begins with the number “9.”

An ITIN does not qualify a person to legally work in the United States and it does not provide eligibility for Social Security benefits. ITIN’s are issued by the Internal Revenue Service for the following U.S. resident status:

- Foreign nationals who do not qualify for Social Security Numbers but who have U.S. federal tax reporting requirements

- Non-resident aliens not eligible for a Social Security Number who are required to file a United States tax return

- Resident aliens filing a U.S. tax return

- Dependents or spouses of U.S. citizens or resident aliens who have U.S. federal tax reporting requirements

- Dependents or spouses of a non-resident alien visa holder who have U.S tax reporting requirements

Dependents will also need an ITIN since they are listed on the tax form.

You need to make sure you file your annual income tax return or else your ITIN will expire. The IRS states ITINs not used on a federal tax return at least once in the last three years will expire.

Filing a DBA

Please fill in as much as you can and then submit your form. We will contact you to complete the LLC process