Knowledge Base: Business Entities and More

The three general factors in choosing the right business entity types are: legal protection, tax treatment, and paperwork requirements. Your choice of business entity determines the amount of taxes you pay, how you raise capital, and what your exposure to risk is if someone tries to sue your business.

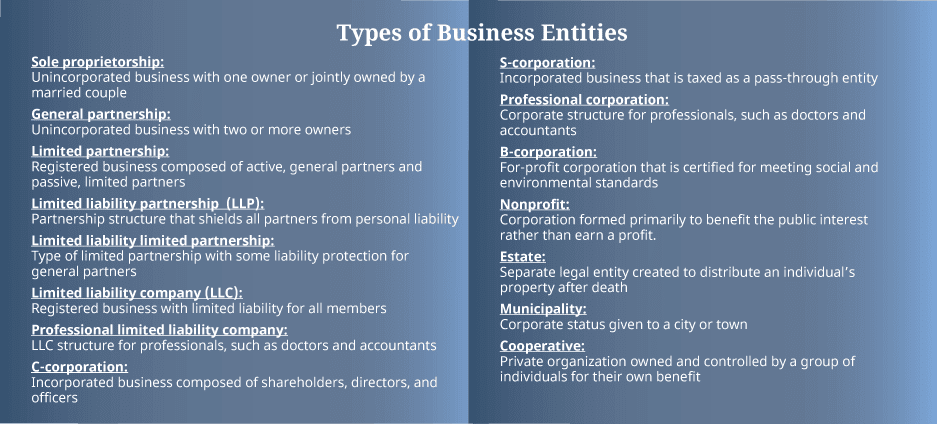

Business entities are governed by state-level legislation so each state has its own laws on requirements, fees, and tax responsibilities. Most small business owners mainly choose these business entity types: sole proprietorship, general partnership, limited partnership (LP), Llimited Liability Company (LLC), C-corporation, and S-corporation.

Sole proprietors and partnerships are light on liability protection, so they come with greater legal risk if your business is sued. However, taxes are simpler and there are fewer state requirements to comply with.

For most freelancers and consultants, the simplicity of a sole proprietor or a partnership makes sense if your field brings little legal risk. As business grows, sole proprietor or partnership may want to consider changing to an LLC or S and C corporations. Converting from a sole proprietor or partnership to an LLC is easier than converting to a corporation, especially if you plan to issue stock. Converting from a C corporation to an S corporation can create a tax liability. In addition, the IRS places certain limits and deadlines on how often you can change your business’s entity type.

On this Page:

- Pros and Cons of a Sole Proprietorship

- Pros and Cons of a General Partnership (GP)

- Pros and Cons of a Limited Partnership (LP) and Limited Liability Partnerships (LLP)

- Pros and Cons of a C-Corporation

- Pros and Cons of an S-Corporation

- Pros and Cons of Limited Liability Company (LLC)

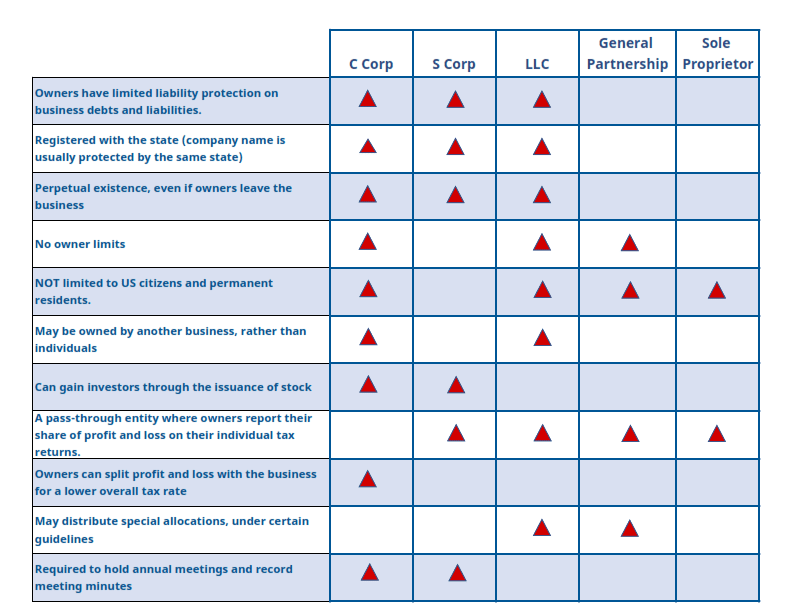

- Business Entity Comparison Chart

- Changing from One Entity Type to Another

- Pros and Cons of a Sole Proprietorship

Great Articles:

- About LLC Taxes - by incfile

- About LLC Taxes - by incfile

Important Disclaimer

Alto CPA Group, LLC CANNOT provide you with legal, or financial advice. Alto CPA Group, LLC is not a law firm. We are not your attorney nor are we a substitute for an attorney, or any other professional service provider. We can aid you in representing yourself. No attorney – client relationship is formed between you and Alto CPA Group, LLC. or any of Alto CPA Group’s employees, independent contractors, representatives, or agents, regardless of whether any of those individuals are attorneys. The Information provided on our Web Site is general information only regarding entity formation and related topics and should not be relied upon by you as legal advice. Although we review your documents for completeness, spelling, grammar and internal consistency, we do not review your documents for legal sufficiency nor do we provide any substantive legal review or make legal recommendations. When you use our Services, you are acting as your own attorney. Setting up a business can be complex and failing to obtain advice from licensed professionals can be costly.

Pros and Cons of Popular

Business Entity Types

Sole Proprietorship

Pros

Cons

A sole proprietorship is a basic and the simplest business entity type to create. When an individual starts a new business, it is automatically a sole proprietorship under state laws. There’s no need to register a sole proprietorship with the state, however you may need local business permits and a license to operate. Freelancers, consultants, and other service professionals normally work as sole proprietors.

As the only owner, you’re personally liable for all of the business’s debts and liabilities—someone who wins a lawsuit against your business can take your personal assets (your car, personal bank accounts, even your home in some situations).

There is no separation between a sole proprietor and the individual so the individual is personally liable for all of the business’s debts and liabilities and the business can be sued along with personal assets. It is also more difficult to raise capital (lenders and investors prefer to work with legal business entities).

- Easy to start up (no need to register your business with the state).

- No corporate formalities or paperwork requirements, such as meeting minutes, bylaws, etc.

- You can deduct most business losses on your personal tax return.

- Tax filing is easy—simply fill out and attach Schedule C-Profit or Loss From Business to your personal income tax return.

- As the only owner, you’re personally liable for all of the business’s debts and liabilities—someone who wins a lawsuit against your business can take your personal assets (your car, personal bank accounts, even your home in some situations).

- There’s no real separation between you and the business, so it’s more difficult to get a business loan and raise money (lenders and investors prefer LLCs or corps).

- It’s harder to build business credit without a registered business entity.

General Partnership (GP)

Pros

Cons

With a general partnership, all partners actively manage the business and share profits. Similar to a sole proprietorship, a business is considered a general partnership for a multi-owner business and there is no need to register a general partnership with the state.

- Easy to start up (no need to register your business with the state).

- No corporate formalities or paperwork requirements, such as meeting minutes, bylaws, etc.

- You don’t need to absorb all the business losses on your own because the partners divide the profits and losses.

- Owners can deduct most business losses on their personal tax returns.

- Each owner is personally liable for the business’s debts and other liabilities.

- In some states, each partner may be personally liable for another partner’s negligent actions or behavior (this is called joint and several liability).

- Disputes among partners can unravel the business (though drafting a solid partnership agreement can help you avoid this).

- It’s more difficult to get a business loan, land a big client, and build business credit without a registered business entity.

Limited Partnership (LP) and

Limited Liability Partnerships (LLP)

Pros

Cons

A limited partnership has two types of partners. One or more general partners and any number of limited partners (or silent partners). General partners manage the business and assume liability, whereas limited partners are investor partners with no control over the business operations and have limited liability up to the amount of equity in the business. LP's give investor/owners the flexibility of avoiding personal liability.

With a limited liability partnership (LLP), none of the partners have personal liability for the business, however, most states only allow law firms, accounting firms, doctor’s, and other professional service firms to organize as LLPs as these types of businesses can avoid each partner from having liability for another partners actions.

- An LP is a good option for raising money because investors can serve as limited partners without personal liability.

- General partners get the money they need to operate but maintain authority over business operations.

- Limited partners can leave anytime without dissolving the business partnership.

- General partners are personally responsible for the business’s debts and liabilities.

- More expensive to create than a general partnership and requires a state filing.

- A limited partner may also face personal liability if they inadvertently take too active a role in the business.

C-Corporation

Pros

Cons

The C corporation is the most common type of corporation in the US since it offers unlimited growth potential through the issuance of stock and there is no limit to the number of shareholders a C corporation can have.

Most small businesses do not elect a C corporation unless there is a good chance they can benefit from the list of pros to the right. From a tax perspective, C corporations get more tax deductions, but double taxation gets in the way so if you plan to rely on issuing dividends, stay away. Owners who want to invest profits into the business will benefit.

- Directors, officers, shareholders, and employees don’t have personal liability for the business’s debts and liabilities.

- C-corporation owners pay lower self-employment taxes.

- You have the ability to offer stock options, which can help you raise money.

- Perpetual existence, even if owners leave the company.

- Enhanced credibility. Gain respect among suppliers and lenders.

- Unlimited growth potential with issuance of stock.

- No shareholder limits. When the company hits a threshold of $10 million in assets and 500 shareholders, it is required to register with the SEC.

- Certain tax advantages. C-corporations are eligible for more tax deductions than any other type of business.

- More expensive to start with many fees that come with filing the Articles of Incorporation and paying the state in which they operate.

- C-corporations face double taxation: The company pays taxes on the corporate tax return, and then shareholders pay taxes on the net earnings distributed as dividends on their personal tax returns.

- Unlike an S corporation, shareholders can't deduct losses on their personal tax returns.

- Regulations and formalities: C corporations must hold board meetings, shareholder meetings, keep meeting minutes, and creating bylaws. They also have more government oversight than other business types due to their complex tax rules and the protection provided to owners from being responsible for debts, lawsuits, and other financial obligations.

S-Corporation

Pros

Cons

Similar to a sole proprietor and partnership, an S corporation profits and losses pass through to the owners’ personal tax returns. To organize as an S corporation or convert your business to an S corporation, you have to file IRS form 2553. S corporations can be a good choice for businesses that want a a pass-through entity with a corporate structure.

- Company directors, officers, shareholders, and employees have limited liability protection on business debts and liabilities.

- An S corporation is a pass-through entity for tax purposes where owners report their share of profit and loss on their individual tax returns. There is no corporate taxation for an S corporation, therefore there is no double taxation of income like C corporations have.

- S corporation can gain investors through the issuance of stock.

- Perpetual existence, even if owners leave the business.

- Once-a-year tax filing requirements versus quarterly for C corporations.

- S corporations are limited to US citizens and permanent residents. Unlike a C corporation and an LLC, you must be a legal resident of the US.

- An S corporation can’t have more than 100 shareholders.

- Must incorporate the business by filing the Articles of Incorporation with the state of incorporation, must obtain a registered agent, and pay fees. Most states have ongoing fees like the annual report fee and/or franchise tax fees. You must comply with corporate formalities, like creating bylaws and holding board and shareholder meetings. Errors in filing can a result in the termination of the S corporation status.

- Payments to employees and shareholders could be distributed as either salaries or dividends, therefore leads the IRS to scrutinize those payments more closely since each is taxed differently.

Limited Liability Company (LLC)

Pros

Cons

LLC's are popular among small business owners because they combine the simplicity of a sole proprietor or partnership with limited liability protection that corporations offer. There are also less requirements than corporations. You can also elect to have the IRS treat you as a corporation or as a pass-through entity on your taxes.

- Owners have limited liability protection on business debts and liabilities.

- An LLC is a pass-through entity for tax purposes where owners report their share of profit and loss on their individual tax returns.

- LLC owners need not be U.S. citizens or permanent residents.

- Your business will look more favorably on when it's an LLC versus a sole proprietor.

- You may choose whether you want your LLC to be taxed as a partnership or as a corporation.

- Not as many corporate formalities compared to an S corporation or C corporation.

- LLC’s cannot issue shares of stock to attract investors.

- It’s more expensive to create an LLC than a sole proprietorship or partnership (requires registration with the state).

- LLC’s can be treated differently by each state.

- Taxes can be imposed on appreciated assets if you convert an existing business to an LLC.

Changing From One Entity Type to Another

No business structure is set in stone and changing to a new entity type can have tax and legal implications. As your business grows, you will have different needs and reviewing every option is expected before embarking on any entity conversion. We are invested in our clients’ success, so please do not hesitate to reach out to us with any questions or if we can help you with any last-minute filings before any tax deadlines.

Here are some conversion options: